Article

Check out our subscription offers.

New subscribers receive over 130 articles in the 22 issues published each year, plus the last five years of issues (that’s over 1,200 articles) as a download link, which are fully searchable in PDF format.

Articles in this Issue

Charts, Tables and Graphs in this Issue

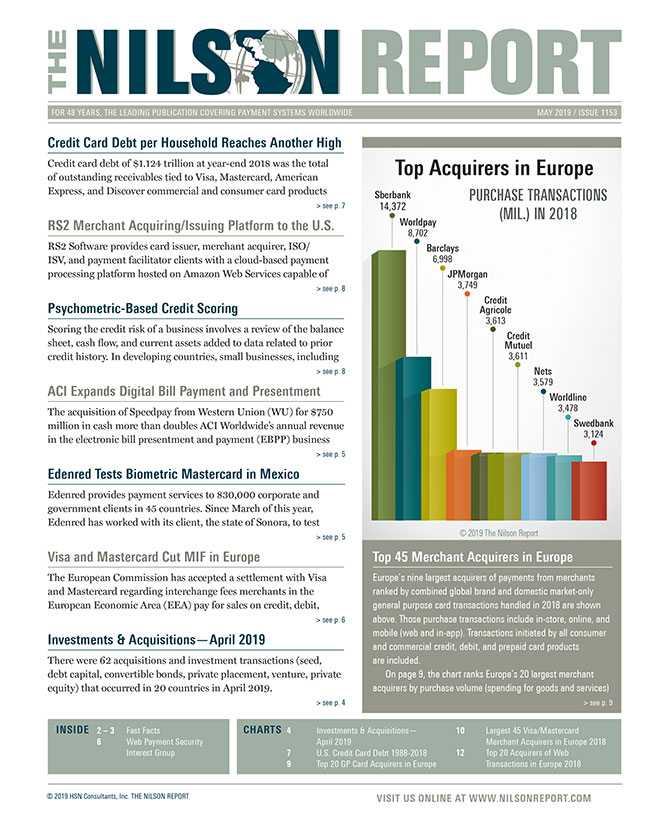

Top Acquirers in Europe Ranked by Purchase Transactions

Investments & Acquisitions—April 2019

U.S. Credit Card Debt 1988-2018

Top 20 General Purpose Card Acquirers in Europe

Largest Merchant Acquirers in Europe 2018—Ranked by Visa/Mastercard Transactions

Top 20 Acquirers of Web Transactions in Europe

Nilson Report

Expertise

Research

News & Events

Subscribe

Connect

Mailing Address:

PO Box 50539

Santa Barbara, CA 93150

USA

Phone:

805-684-8800