Featured Article

Merchant, seller and advertiser risk intelligence is the business of LegitScript, which protects payment processors, search engines, social media platforms and ecommerce marketplaces against regulatory violations, reputational damage or financial risk from merchants that violate laws, rules or regulations or sell goods and services that are illicit or problematic.

LegitScript also vets merchants that sell in highly regulated industries using an in-house legal team that is expert in the regulatory guidelines of more than 100 jurisdictions worldwide.

The company uses AI-based monitoring products to scan, summarize and analyze content on the commercial web to quickly detect risk. That analysis is aided by a database of 15 years of merchant data. Early detection helps LegitScript’s clients avoid fines from card networks as well as prevent scrutiny from regulators.

Last year, LegitScript saved clients $1.60 billion in potential card network fines. It works with merchant acquirers, payment service providers (PSPs) and independent sales organizations (ISOs) when onboarding new merchants and then subsequently monitors their sales and advertising as well as any changes they make to their websites. Because it monitors merchants, their ads, listings and other user-generated content, it can provide a full perspective on activity across the internet.

A notable problem in the card industry involves transaction laundering—merchants that claim to sell an innocuous product when they are actually selling products or services that are illicit. Transaction laundering is difficult to detect. And when caught, these criminals typically seek another acquirer, or sometimes wait and reapply to the same acquirer. They can game the system because there is no industry-wide list of fraudulent merchants.

LegitScript’s Marketplace Monitoring product reviews merchant profiles, products and other content. Its Ad Monitoring product reviews advertisements on search engines and other platforms. Merchant Onboarding and Merchant Monitoring examine profiles and websites for any activity that violates laws, rules or regulations. The company’s Xray platform identifies sellers that were previously connected to fraud or transaction laundering, providing a warning to acquirers, PSPs and ISOs to drop them at the underwriting or onboarding stage.

The examination of a merchant includes more than 60 high-risk areas, including intellectual property, gambling, weapons and pharmaceuticals. Transaction laundering detection involves undercover test transactions and internet investigations. Merchant category code (MCC) detection operates automatically and provides confidence ratings and high-risk/mismatch flags.

In addition to its own database, which is comprised of billions of merchant data points, LegitScript also accesses third-party data to provide additional intelligence on merchant behavior including know your business (KYB) checks.

The company does not provide a numerical risk score. Instead, it provides structured data points with detailed notes from an analyst that help risk and compliance teams understand why a merchant has been flagged.

LegitScript employs experts fluent in more than 20 languages to support PSPs, search engines and marketplaces worldwide. US-based merchant acquirers, payment facilitators and processors that have adopted LegitScript’s technology include Shift4, Square, North and Avidia Bank.

LegitScript, which is SOC 2 Type 2 compliant and meets ISO 27001 standards, charges clients on a per-merchant basis and on the number of products they want to use.

Articles in this Issue

Charts, Tables and Graphs in this Issue

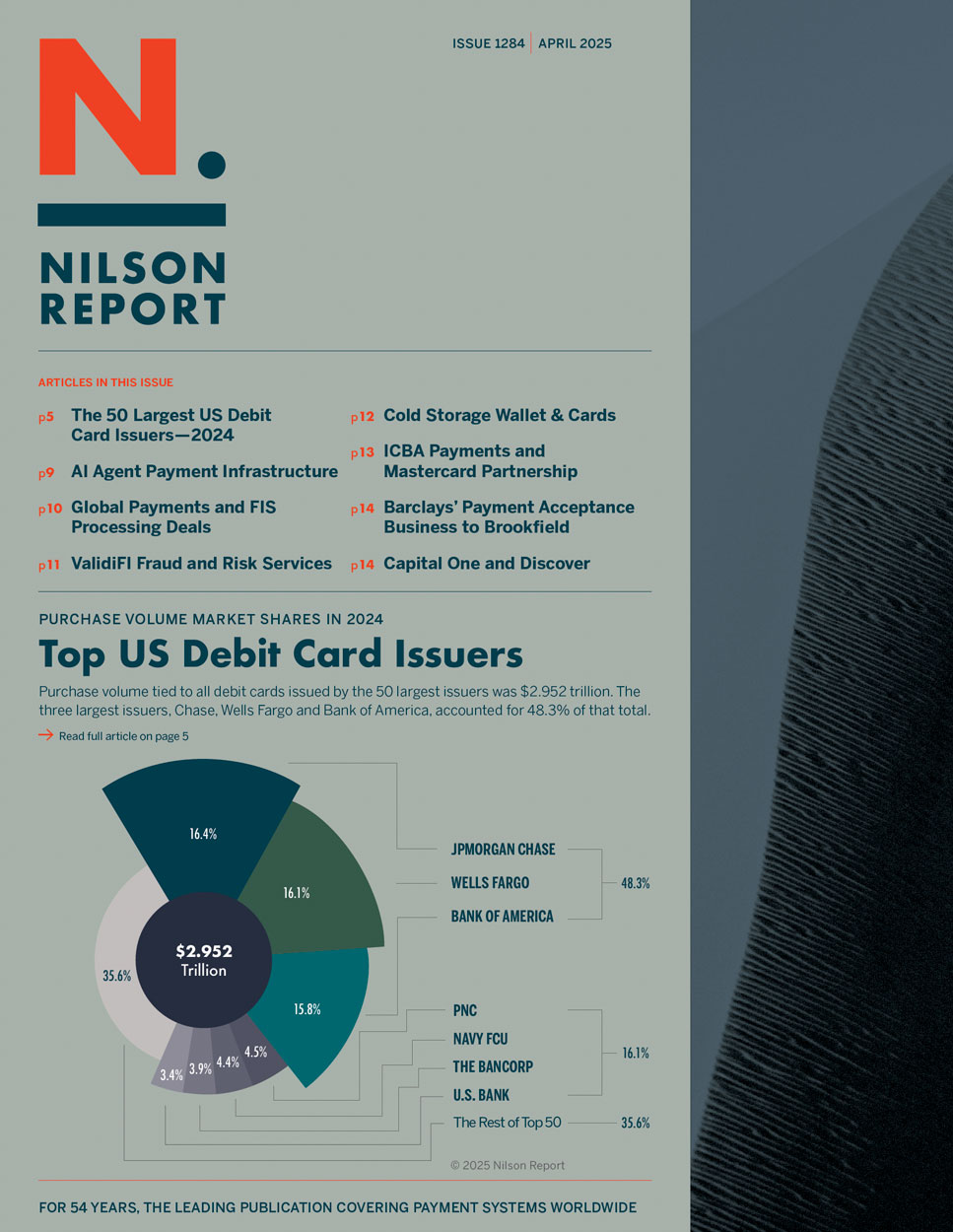

Top US Debit Card Issuers

Market Shares of Debit Products Among the Top 50 US Issuers

10 Largest Debit Card Issuers Ranked by Purchase Volume in 2024 with Percentage Change vs. 2023

Top 50 Debit Card Issuers in the US Ranked by Purchase Volume in 2024

Top US Debit Card Issuers by Transaction Type

Publicly Traded Companies in Payments

Nilson Report

Expertise

Research

News & Events

Subscribe

Connect

Mailing Address:

PO Box 50539

Santa Barbara, CA 93150

USA

Phone:

805-684-8800