Article

Check out our subscription offers.

New subscribers receive over 130 articles in the 22 issues published each year, plus the last five years of issues (that’s over 1,200 articles) as a download link, which are fully searchable in PDF format.

Articles in this Issue

Charts, Tables and Graphs in this Issue

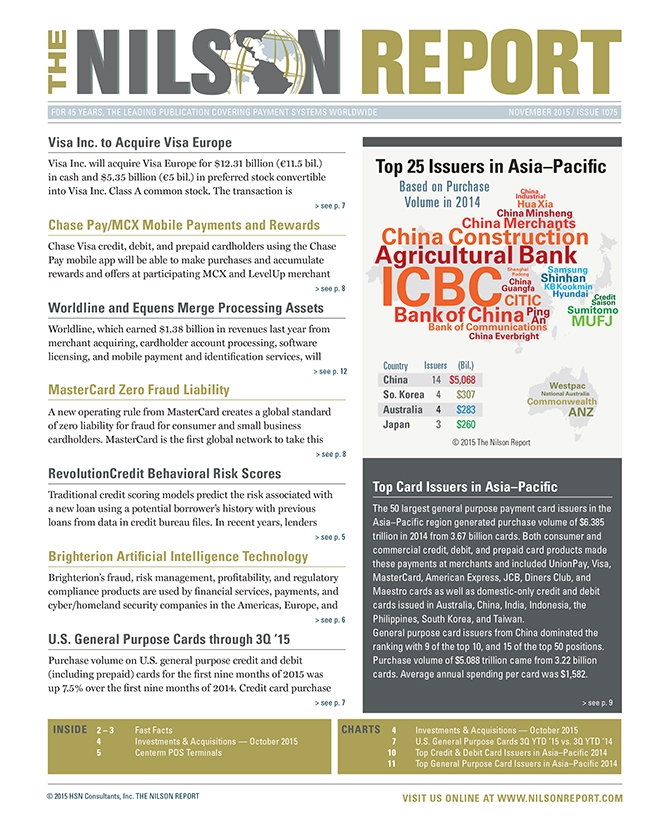

Top 25 Issuers in Asia-Pacific 2015

Investments & Acquisitions – October 2015

U.S. General Purpose Cards 3Q YTD ’15 vs. 3Q YTD ‘14

Top Credit Card Issuers in Asia-Pacific 2014

Top Debit Card Issuers in Asia-Pacific 2014

Top General Purpose/Visa/MasterCard Card Issuers in Asia-Pacific 2014