Menu

The following companies are featured in this issue of the Nilson Report. News about companies appears in feature articles, as well as in the First Look and Management Changes sections of the newsletter. To submit general information about your company, or to share news with us, please contact us.

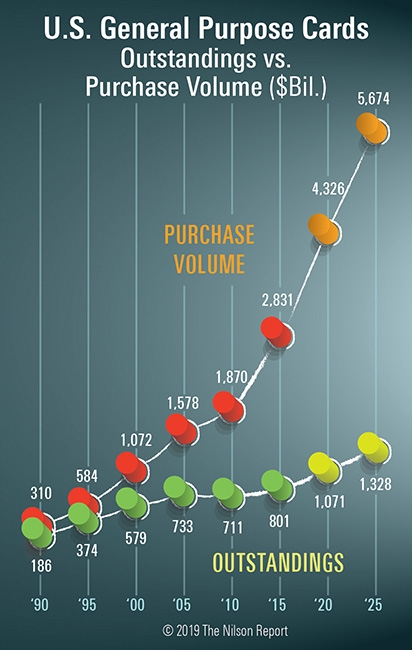

U.S. General Purpose Cards, Outstandings vs. Purchase Volume

Investments & Acquisitions—December 2018

Projected Growth of Purchase Transactions Worldwide

Outstandings as a Percentage of Purchase Volume on U.S. General Purpose Cards 1990-2018

A total of 43 acquisitions, joint ventures, and investment transactions occurred in 12 countries in December 2018. The top five deals with disclosed values are listed below.

1. Earthport, United Kingdom

Visa, $252.0 mil.

2. Plaid, United States

Series C, $250.0 mil.

3. Earnin, United States

Series C, $125.0 mil.

4. Danal, South Korea

Boku, $112.0 mil.

5. Cross River Bank, United States

Venture round, $100.0 mil.

Full access to the Investments & Acquisitions—December 2018 table is available when you subscribe to The Nilson Report.

Nilson Report

Expertise

Research

News & Events

Subscribe

Connect

Mailing Address:

PO Box 50539

Santa Barbara, CA 93150

USA

Phone:

805-684-8800