The following companies are featured in this issue of the Nilson Report. News about companies appears in feature articles, as well as in the First Look and Management Changes sections of the newsletter. To submit general information about your company, or to share news with us, please contact us.

The Nilson Report takes editorial independence very seriously. We are just as serious about maintaining our copyright: Every reader of the Nilson Report must purchase a copy of it. Ours is not a free publication supported by advertising. Therefore, this issue cannot be forwarded or otherwise shared with colleagues. We recognize though, that businesses want to share information. To that end, when the Nilson Report features a company, they may always request a reprint that they can share with clients or online, via social media. If that is the case with your company, do reach out. We are happy to oblige.

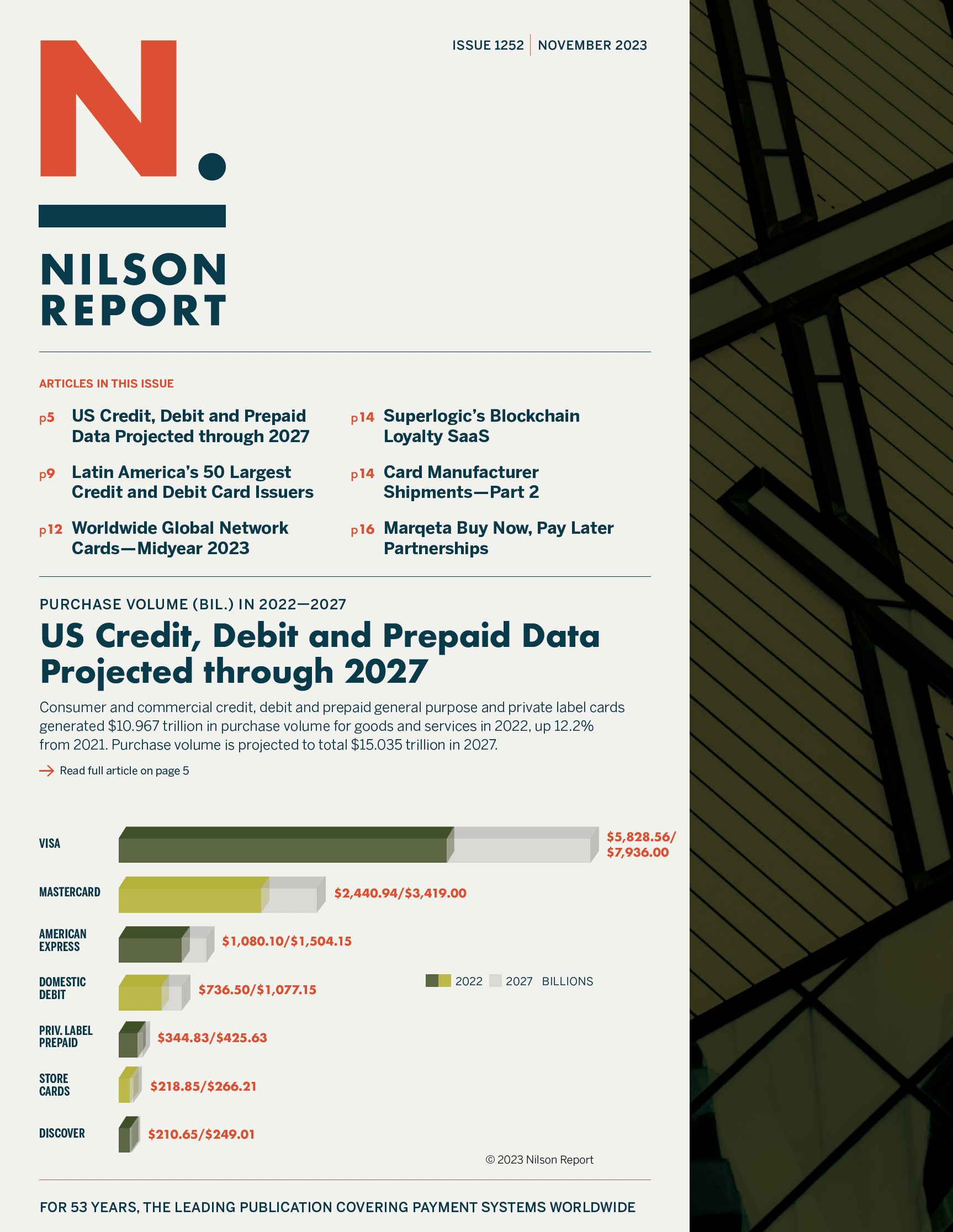

US Credit, Debit and Prepaid Data Projected through 2027: Visa, Mastercard, American Express, Domestic Debit, Private Label Prepaid, Store Cards, Discover

US Credit Card Purchase Volume 2022 vs. 2027: Visa, Mastercard, American Express, Store, Discover

US Debit Purchase Volume 2022 vs. 2027: Visa, Mastercard, Domestic Debit, Prepaid

US Purchase Transactions 2017 vs. 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, Private Label Prepaid, ACH Retailer Debit, Debit Card Totals, Credit & Debit Totals

US Purchase Volume 2017 vs. 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, Private Label Prepaid, ACH Retailer Debit, Debit Card Totals, Credit & Debit Totals

US Total Transactions 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, Private Label Prepaid, ACH Retailer Debit, Debit Card Totals, Credit & Debit Totals

US Total Volume 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, Private Label Prepaid, ACH Retailer Debit, Debit Card Totals, Credit & Debit Totals

US Credit Card Outstandings 2013 through 2022: Visa, Mastercard, Store, American Express, Discover, The Rest,

US Outstandings 2022 vs. 2027: Visa, Mastercard, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals

US Cards 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, Private Label Prepaid, ACH Retailer Debit, Debit Card Totals, Credit & Debit Totals

US Cardholders 2022 vs. 2027: Visa Credit, Mastercard Credit, American Express, Discover, Store, Oil Company, The Rest, Credit Card Totals, Visa Debit & Prepaid, Mastercard Debit & Prepaid, Domestic Debit, ACH Retailer Debit, Debit Card Totals

Latin America’s Top 8 Visa and Mastercard Issuers Ranked by Combined Credit and Debit CardPurchase Volume

50 Largest General Purpose Card Issuers in Latin America

50 Largest Credit Card Issuers in Latin America

50 Largest Debit Card Issuers in Latin America

Worldwide Global Brand General Purpose Card Results Midyear 2023 with Change vs Midyear 2022

Card Manufacturers 2022—Part 2

Investments & Acquisitions—October 2023

Publicly Traded Companies in Payments

Worldwide Global Brand General Purpose Card Results Midyear 2023 with Change vs Midyear 2022

From January 1 through June 30, 2023, Visa, UnionPay, Mastercard, JCB, Discover/Diners Club and American Express brand cards generated $17.791 trillion in purchases of goods and services. The top four card brands in the first six months of 2023 are ranked below.

UnionPay

$7.021 trillion purchase volume

Visa

$6.124 trillion purchase volume

Mastercard

$3.546 trillion purchase volume

American Express

$0.817 trillion purchase volume

Full access to Worldwide Global Brand General Purpose Card Results Midyear 2023 with Change vs. Midyear 2022 results is available when you subscribe to the Nilson Report

Our Free Trial Offer Just Got an Upgrade

Start Two Months of Full Access to the Nilson Report

Free trial access now includes all subscriber benefits, including complete data tables on issuers and acquirers worldwide and our exclusive subscriber portal.

No Restrictions. No payment card required.

See why executives in 80+ countries rely on the Nilson Report for best-in-class data and business intelligence.