Featured Article

There are more than 3.00 billion smartphones worldwide with preinstalled Apple and Google wallets. At a combined 1.10 billion, Apple Pay and Google Pay apps dominate the usage of those wallets. However, both wallets can support far more functionality than a simple static payment app.

Badge offers card issuers, retailers and other companies the infrastructure layer technology that turns Apple and Google wallets into programmable, real-time interactive channels that can be used for branded loyalty and rewards programs, membership passes, private label prepaid cards, tickets, marketing messages and more.

Some companies, including Square and most US airlines, have built Apple and/or Google wallet functionality in-house. Airline boarding passes are the best known use case.

Other companies recognized that in-house development required deep Apple and Google platform knowledge, which was time consuming as well as costly to attain, and so opted to use Badge. Those companies include Stripe, Synchrony, EY, Shift4, Wex, Hoka and Carrefour.

They pay Badge a platform fee for a custom integration with the company’s APIs as well as ongoing engineering support. They also pay a per-message fee to dynamically interact with their customers’ wallets. Those per-message fees are less than the cost of an SMS text. Importantly, every message to an Apple or Google wallet is guaranteed to be delivered to an existing customer, which is not always the case when sending messages in other channels.

Data, images, links and notifications can be updated automatically, which helps drive traffic to websites, mobile apps and physical stores. Messages can pertain to: limited-time offers; buy now, pay later; card upgrades; and savings and checking account offers. Real-time awareness of the cardholder’s location (branch, ATM, in-store) can inform content and value propositions delivered.

Customers opt in one time. Subsequent notifications are enabled by default.

Leveraging Apple and Google wallets makes sense, in large part, owing to their ubiquity. There are roughly three times as many Apple and Google wallets worldwide as there are active monthly users of the global Tik Tok social media platform.

Consumers are fatigued with proprietary apps, while they have become accustomed to making contactless payments from their phones.

Badge has raised $17.1 million in capital since its founding in 2023. A $13.8-million Series A round in December 2025 was led by TTV Capital, with participation from Stripe, Synchrony Ventures and Infinity Ventures.

INTERVIEWED FOR THIS ARTICLE Eric Senn is Chief Executive Officer at Badge in San Francisco, California, eric@trybadge.com, www.trybadge.com.

Articles in this Issue

Charts, Tables and Graphs in this Issue

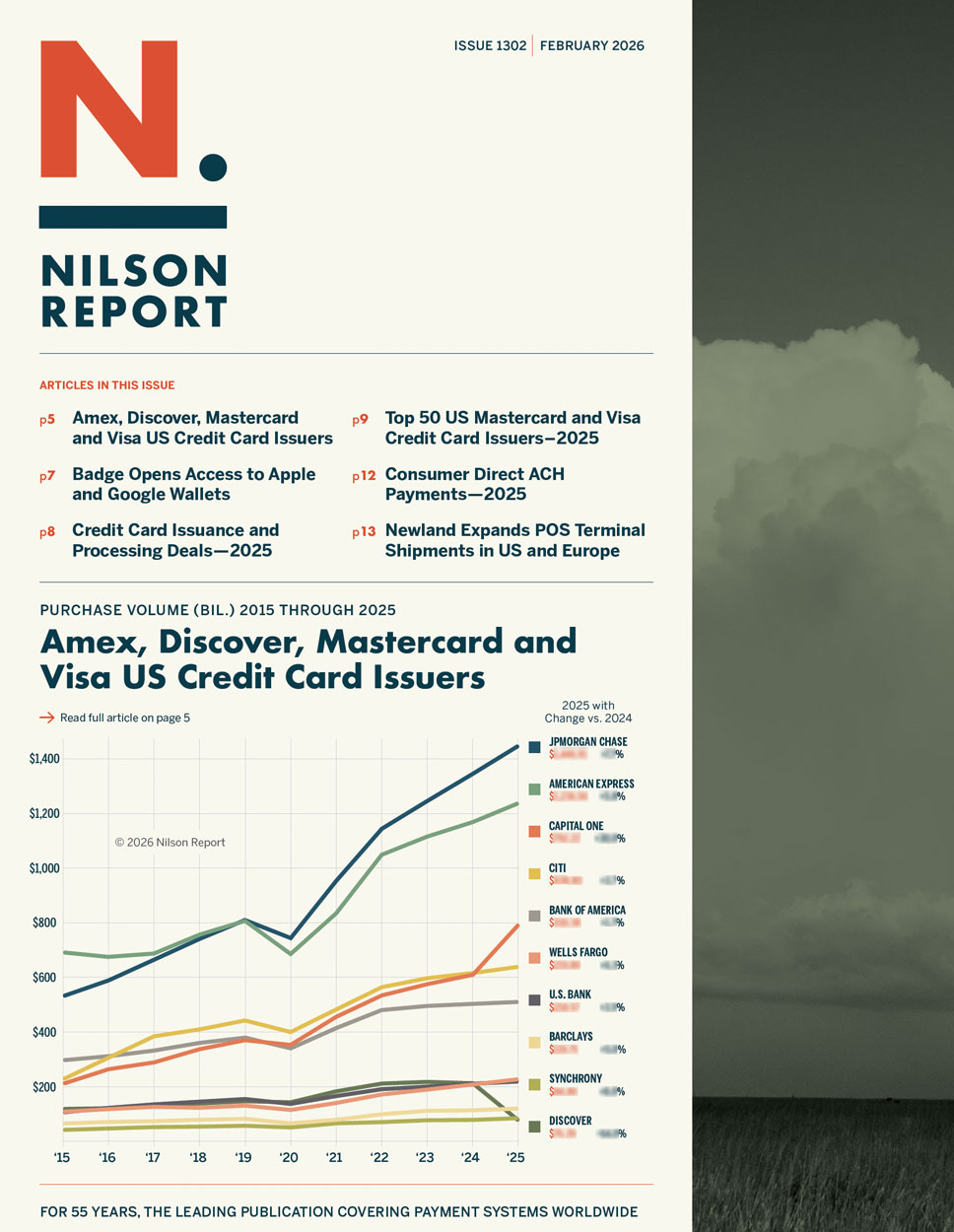

Amex, Discover, Mastercard and Visa US Credit Card Issuers in 2025

Market Shares of Purchase Volume for General Purpose Credit Card Issuers

The 30 Largest US Credit Card Issuers — 2025

Card Account Processing and Card Issuance Deals (Commercial Card Issuing)

Card Account Processing and Card Issuance Deals (Card Issuer Processing)

Card Account Processing and Card Issuance Deals (Consumer Card Issuing)

Top 15 Mastercard and Visa Credit Card Issuers in the US (Ranked by Outstandings 2019-2025)

Top 50 Mastercard and Visa Credit Card Issuers in the US (Ranked by Outstandings in 2025)

Consumer Direct ACH Transactions — 2025

Publicly Traded Companies in Payments