The following companies are featured in this issue of the Nilson Report. News about companies appears in feature articles, as well as in the First Look and Management Changes sections of the newsletter. To submit general information about your company, or to share news with us, please contact us.

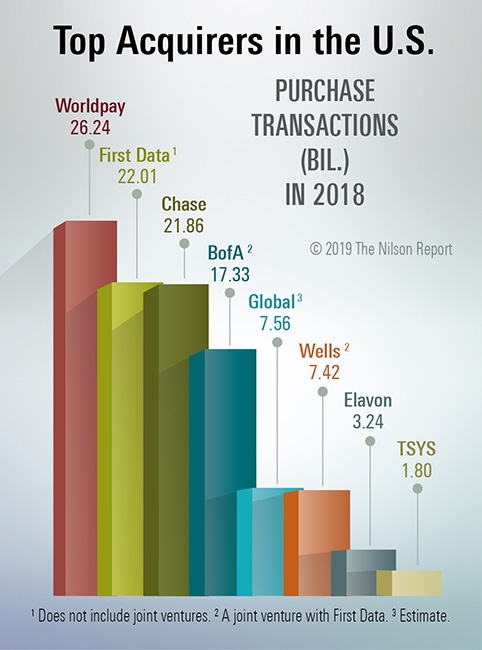

Top Acquirers in the U.S.

Investments & Acquisitions—February 2019

U.S. Acquirer Totals—2018 Ranked by Purchase Volume and Purchase Transactions

Top Merchant Acquirers in the U.S.—2018 Ranked by Visa/Mastercard Volume

Card Not Present (CNP) Acquiring in the U.S.—2018

Based on Visa and Mastercard credit, debit, and prepaid purchase volume processed in the United States, the 5 largest merchant acquirers are listed here.

1. Chase Merchant Services, Texas

$1,041.95 bil. V/MC volume, +15.0%

2. Bank of America, Georgia

$684.57 bil. V/MC volume, +6.2%

3. Worldpay, Ohio

$655.59 bil. V/MC volume, +5.3%

4. Wells Fargo, California

$421.19 bil. V/MC volume, +23.9%

5. Global Payments, Georgia

$333.84 bil. V/MC volume, 3.4%

Full access to the Merchant Acquirers in the U.S. 2018—Ranked by Visa/Mastercard Volume results is available when you subscribe to The Nilson Report./em>

Our Free Trial Offer Just Got an Upgrade

Start Two Months of Full Access to the Nilson Report

Free trial access now includes all subscriber benefits, including complete data tables on issuers and acquirers worldwide and our exclusive subscriber portal.

No Restrictions. No payment card required.

See why executives in 80+ countries rely on the Nilson Report for best-in-class data and business intelligence.